A mortgage account can be a fiscal arrangement put in place among a borrower as well as a lender, usually a lender or fiscal establishment, to track the equilibrium, fascination, and repayments on borrowed funds. In the united kingdom, these accounts range from particular loans to mortgages and business enterprise loans, Every single serving various money wants.

The DSCR is often a crucial metric utilized by lenders to ascertain an Trader's power to cover mortgage payments with the revenue produced with the residence. The system to work out DSCR is: DSCR =

Lenders will need to see a gentle revenue or funds move that suggests your ability to make bank loan repayments. This might come from work, a business, as well as remittances. 3. Local community or Particular References

Get yourself a Loan? At Paydayloanspot.com, we imagine All people justifies use of the hard cash they have to have, it doesn't matter their credit heritage. With our very simple and safe sort, you’re just times away from getting the financial loan you need—as many as $5,000 or maybe more!

At that point, Microsoft Promoting will make use of your complete IP deal with and consumer-agent string so that it might thoroughly procedure the advertisement click on and cost the advertiser.

For bigger loans like residence mortgages or company expansion, lenders may demand assets as collateral, like land or vehicles. If you're in Ghana, think about applying with Option Global Discounts and Loans Constrained. Be a part of me tomorrow for Working day six, in which we’ll investigate how your financial savings and banking habits can affect your use of credit.

Late payment charges vary by lender. Established reminders to stay away from penalties, and contact your lender for aid with late payments. one Lender Alternatives

What on earth is “Once-a-year Proportion Fee” – APR? Our particular financial loan lenders do the job nationwide and consistently seek to provide you with the cash you are searhing for. These financial loan merchandise have a minimum of sixty one-day as well as a optimum of seventy two-month repayment terms.

Cross-collateralization alternatives available to make the transition from their current property for their future a person sleek and worry-free.

How Are Bank loan Payments Dealt with? You’ll find that all lenders have their solutions, schedules, and phrases for mortgage repayment. Please examine your bank loan agreement and make sure that you realize the conditions contained in it.

Optimize Income Movement: Benefit: By securing a DSCR personal loan with a good ratio, you'll be able to make certain that the property generates ample cash flow to protect debt payments and potentially deliver more income flow. This allows in keeping liquidity and reinvesting in more Houses.

10 Ideal Web sites for Personal Loans ten Most effective Internet sites for private Loans Personal loans are a fantastic selection for funding significant costs, consolidating credit card debt, or funding Distinctive projects. The rise of on the web lending platforms has built it simpler than ever before to search out aggressive fees and versatile conditions. Whether or not you've got great credit rating or wish to help your financial situation, there’s a personal personal loan selection for you. Allow me to share 10 of the best Internet sites for personal loans, Every providing different features to fulfill your requirements. --- 1. LendingClub LendingClub is one of the preferred peer-to-peer lending platforms, presenting personalized loans for various reasons. It connects borrowers with person buyers, which makes it easier to protected loans with competitive rates. Why It really website works: LendingClub presents versatile loan conditions (3 to five a long time), reduced-desire costs, and the choice for credit card debt consolidation or funding significant everyday living bills. Important Options: Bank loan quantities from $1,000 to $forty,000 Aggressive curiosity fees (starting up around seven%) Rapid software method Own mortgage selections for great to great credit scores --- 2. SoFi SoFi is recognized for its aggressive rates, no charges, and Remarkable customer service. It’s a terrific option for borrowers with good credit score who are searhing for adaptable loan terms. SoFi also offers vocation coaching and economical preparing, making it a comprehensive selection for personal finance. Why It Works: SoFi’s individual loans include no costs, which include origination or prepayment service fees, and a straightforward on line software process.

“RCP enables them to reach their present prospects in a new way, offer much more value, and build loyalty.” RCP is currently available for personal loans and Upstart designs to extend This system to car loans and home equity strains of credit rating Later on. At present, over 20 lenders within Upstart’s community are previously making use of RCP. Charles Eads, Chief Lending Officer of 1 this sort of lender, Abound Credit Union, pointed out RCP’s probable to help you the credit score union provide associates beyond its normal geographic boundary. “RCP will allow us to retain and improved serve our present associates,” said Eads. “This ground breaking software will allow us to carry on to fulfill the fiscal requirements of our customers within the communities we provide, in addition to All those members who may have moved beyond the realm.” California-dependent Upstart was founded in 2012 to leverage AI and device Discovering to price credit score and automate the borrowing course of action. The corporate shut its IPO in 2020 and it is at this time traded on the NASDAQ beneath the ticker UPST that has a market capitalization of $2.02 billion. Photograph by Monica Silvestre The article Upstart Launches RCP, a Tool to aid Financial institutions Customise Personal loan Offers appeared very first on Finovate. through Finovate April 29, 2024 at 07:45PM

Simply how much Will Borrowing Cost Me? Paydayloanspot.com would not include support costs. We hook up borrowers by using a lender, and we won't ever cost costs. Nevertheless, your lender may incorporate additional expenditures if accepted for just a bank loan and settle for the supply.

Obviously outlining how you intend to make use of the bank loan—irrespective of whether it’s for expanding a company, developing a home, or covering training fees—can bolster your situation. 5. Collateral (for Secured Loans)

Edward Furlong Then & Now!

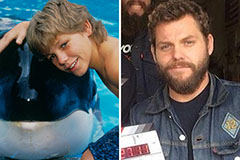

Edward Furlong Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!